Rare Earth Minerals: History, Uses, and China's Dominance

A look at the critical components of modern technology and geopolitics

Introduction

Many of us have heard a lot about “rare earth minerals” or “magnets” recently. These items are often mentioned in connection with the tit-for-tat tariff escalations between United States and China. These rare earth resources are one of China’s most significant points of leverage over the United States. However, many of us are unaware of what they truly are or how they are utilized.

Rare earth minerals are indispensable to the modern technological world. These elements, which include a group of 17 metallic elements such as neodymium, dysprosium, and yttrium, are used in a wide variety of applications, from smartphones and electric vehicles to wind turbines and military equipment. Despite their name, most rare earth minerals are relatively abundant in the Earth's crust, but their dispersion makes them difficult to mine economically. Over the past several decades, these minerals have emerged as a focal point of geopolitical and economic competition, particularly as China's growing dominance in this field has become increasingly evident.

If it sounds odd that these elements are actually not that “rare” in the traditional sense, why does China seem to have a lock on them?

The Historical Context

Rare earth minerals were first discovered in the late 18th century. The term "rare earth" originated from the scarcity with which these minerals were initially found, particularly in a Swedish mine. For much of the 19th and early 20th centuries, rare earths were scientific curiosities rather than industrial necessities. Their unique magnetic, luminescent, and catalytic properties gradually unlocked their potential, particularly after World War II.

During the 1940s and 1950s, the United States took an early lead in rare earth production. Mountain Pass Mine in California became the world's most significant source of rare earths by the mid-20th century. These minerals were crucial to defense technologies during the Cold War, fueling advancements in radar systems, jet engines, and other applications. However, as environmental concerns and competition diminished the profitability of mining, the U.S. ceded its leadership role, allowing other nations to step in.

It is important to understand that the United States knowingly encouraged moving the production of rare earth minerals to China. The output was expensive compared to mining a processing the minerals overseas. Maybe the final straw which closed the Mountain Pass Mine was a toxic spill. It was decided by corporate owners, with the backing of the US Government, to outsource production to areas with fewer environmental laws. Production stopped in 2002. China had much weaker environmental laws and much lower wages.

In retrospect, this was an idiotic decision. Not just the idea of giving China leverage over our manufacturing base, but also allowing China the ultimate leverage over new military systems. Rare earth minerals are a resource that the United States should subsidize. I understand that subsidizing most businesses is a poor business decision, but choosing to forgo access to these minerals was even more asinine.

Applications and Their Importance

Rare earth minerals play a crucial role in modern technology and industry. Their unique chemical and physical properties make them irreplaceable in several high-tech applications:

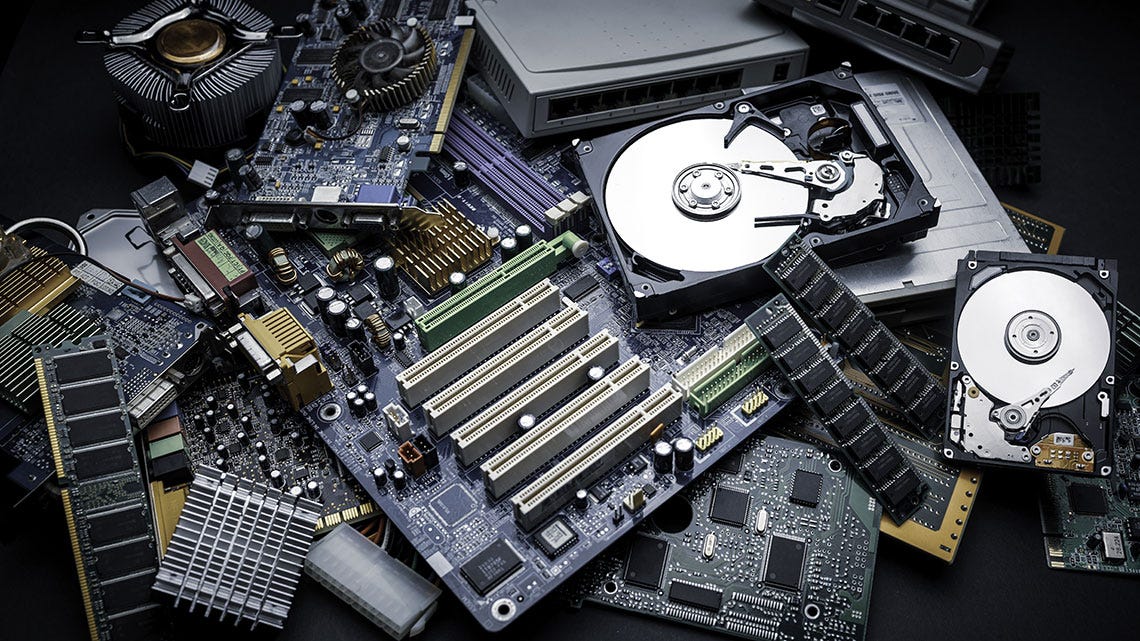

· Electronics: Rare earth elements such as neodymium are used in the production of powerful magnets found in hard drives and speakers.

· Green Energy: Wind turbines and electric vehicles rely on rare earth magnets to boost efficiency.

· Lighting: Phosphors derived from rare earths are used in LED and fluorescent lighting.

· Military: Rare earths are critical for precision-guided weapons, drones, and advanced communication systems.

· Healthcare: Certain rare earths are used in MRI machines and other diagnostic equipment.

The growing demand for these minerals in renewable energy technologies and electric mobility underscores their pivotal role in transitioning to a sustainable future.

China's Rise to Dominance

China’s dominance in rare earth minerals is the result of strategic planning, abundant reserves, and a willingness to invest in the industry despite environmental and financial challenges.

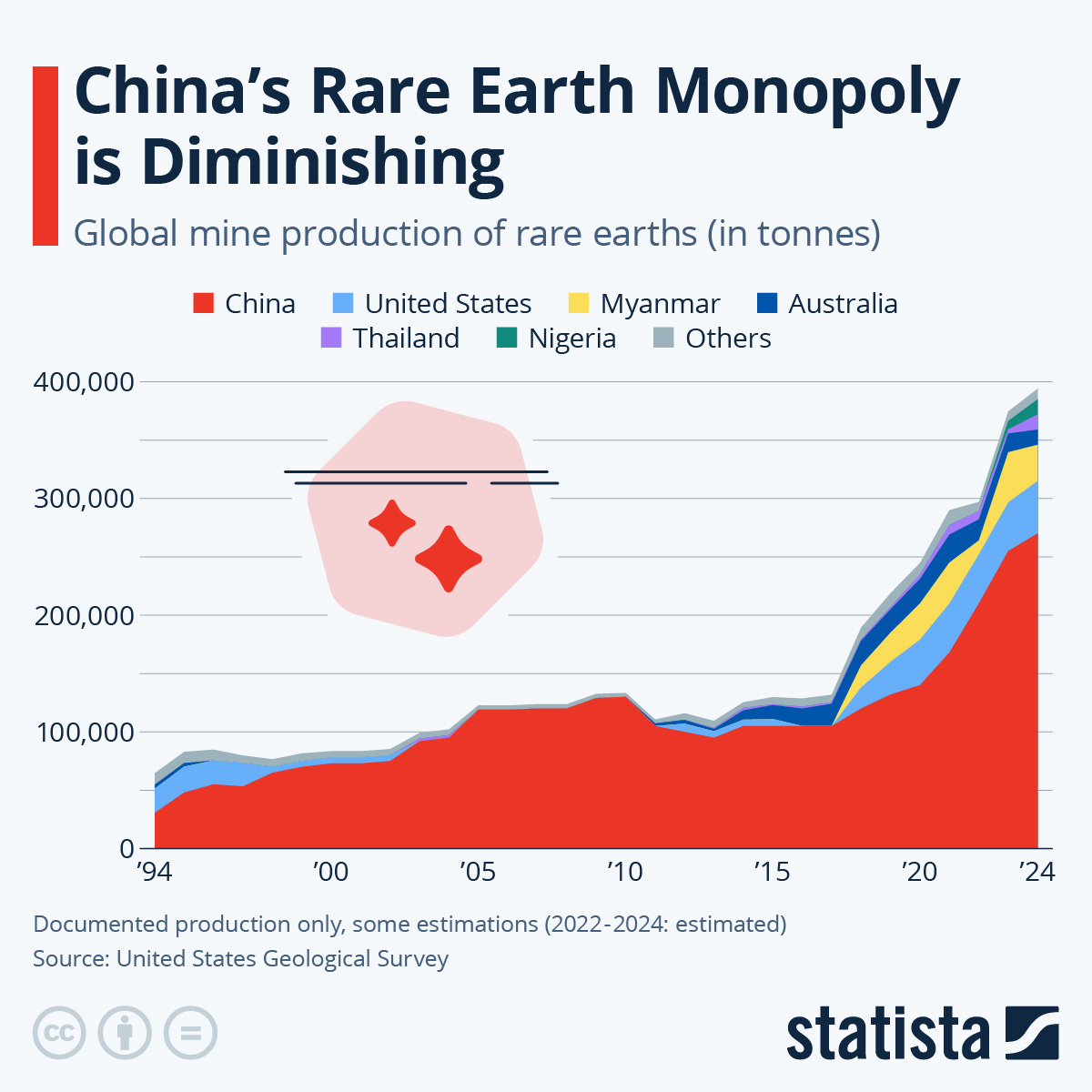

In the 1980s, China began to recognize the economic and strategic value of rare earths. It ramped up production, leveraging its vast deposits, particularly in Inner Mongolia’s Bayan Obo Mine. By the 1990s, China had surpassed the United States in production output, buoyed by aggressive pricing policies that undercut competitors worldwide. China’s state-backed enterprises were able to absorb costs that private companies in other nations could not, effectively monopolizing the market.

China's dominance extends beyond mining; it also leads the world in refining and processing rare earths. Processing these minerals is a complex and environmentally hazardous endeavor that requires extensive investment in specialized facilities. By controlling both mining and processing, China has established itself as the supplier of choice for global tech and manufacturing industries. In such a case, China’s ability to ignore its citizens’ protests at the time was beneficial. The environmental effects can be extremely toxic.

China’s Strategy

China’s rare earth strategy is not merely economic; it is deeply intertwined with its geopolitical ambitions. Rare earth exports have been weaponized as a tool of diplomacy and leverage. For instance, during a territorial dispute with Japan in 2010, China temporarily restricted rare earth shipments, highlighting its control over this critical resource. Such actions have spurred global concerns over the reliability of supply chains and intensified efforts to diversify sources.

Chinese dominance in these resources was also a key motivator for the trade discussions over tariffs that are ongoing despite two announcements that a framework is close.

Can the United States and Other Nations Catch Up?

The U.S. and other nations are increasingly aware of the importance of reducing dependence on China for rare earth minerals. However, catching up poses significant challenges in terms of cost, infrastructure, and environmental regulations.

Efforts to Revive Domestic Production

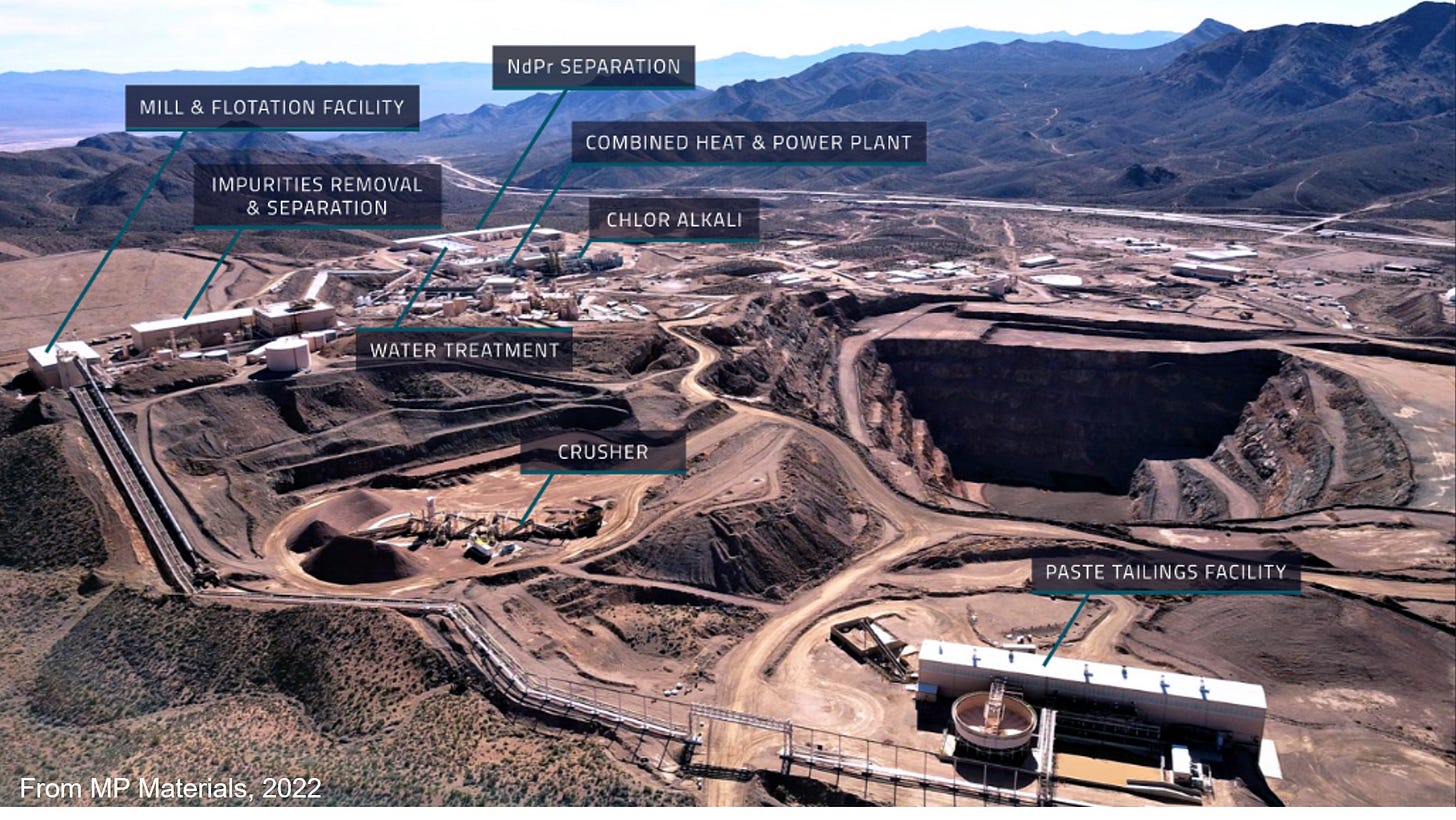

In recent years, the United States has taken steps to revive its rare earth industry. Mountain Pass Mine in California resumed operations, but its output is still insufficient to compete with China. Additionally, much of the mined material from Mountain Pass is sent to China for processing, underscoring the gap in processing capabilities.

The U.S. government has recognized the strategic importance of rare earth minerals and allocated funding for research, mining, and processing through initiatives such as the Defense Production Act. Collaborations between private companies and federal agencies aim to develop more efficient and environmentally sustainable methods of extraction and processing.

International Cooperation

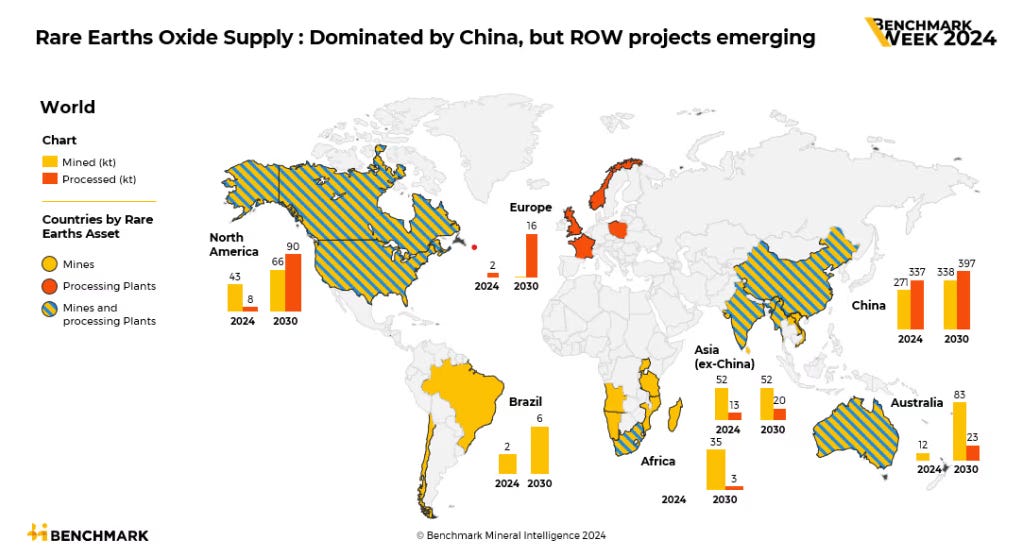

Other nations, including Australia, Canada, and those in the European Union, are also ramping up efforts to establish themselves as reliable suppliers. Australia, for instance, has significant reserves and is actively partnering with countries like Japan and the United States to diversify supply chains. The European Union is investing in recycling technologies to reduce reliance on primary extraction, while Japan has turned to deep-sea mining to access untapped reserves.

Brazil is possibly another major contributor to the world’s supply chain. Only China appears to have more rare earths than Brazil does.

Challenges

Despite domestic and international efforts, significant hurdles remain. Rare earth mining and processing are environmentally damaging, often generating radioactive byproducts. Implementing stringent environmental regulations increases costs, making it difficult for competitors to match China’s low-cost production. Additionally, building a complete supply chain—from mining to processing to manufacturing—takes time and substantial investment.

Innovation may provide a path forward. Researchers are exploring alternative materials that could replace rare earths in certain applications, as well as methods of recycling rare earths from discarded electronics. While these developments show promise, they are unlikely to eliminate the need for mining in the near future.

The Future

Rare earth minerals are essential for modern technology, renewable energy, and defense systems. China’s dominance in this field results from strategic foresight, abundant resources, and aggressive economic policies. All of this was well understood by US and other corporations and governments. However, other companies and governments took advantage of the lower prices charged by China, which undermined and then destroyed national production.

The leverage China has during the recent tariff negotiations has highlighted America’s dependence on the Chinese government. The United States and other nations are taking steps to reduce dependence on Chinese supplies. However, catching up will require significant investment, international collaboration, and innovation. In the United States, it would also require some form of indemnity for the Government and producers.

As global demand for rare earths continues to rise, the competition over these critical resources is likely to intensify. Whether through the revival of domestic industries, partnerships among nations, or breakthroughs in alternative technologies, the effort to diversify supply chains remains one of the key challenges of the 21st century. The race for rare earths is not just about economics; it is about security, sustainability, and shaping the future of geopolitics.