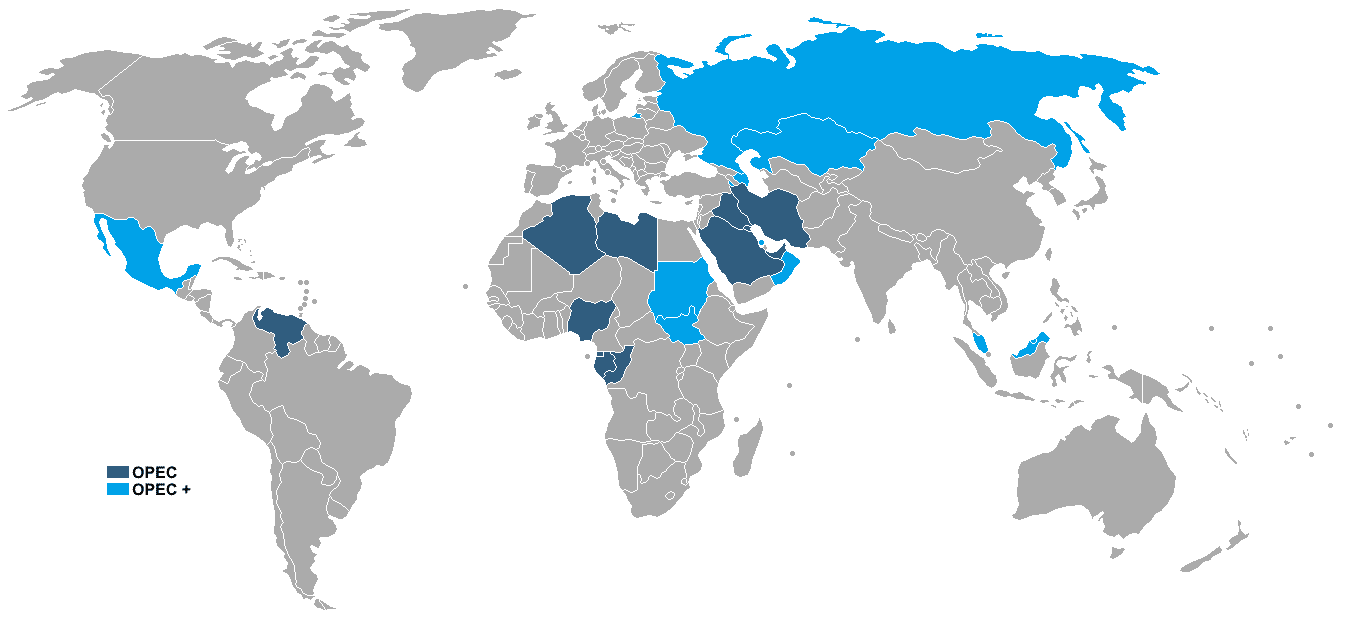

OPEC is the acronym for the Organization of Petroleum Exporting Countries. It first came to widespread attention in the 1973 oil crisis. This was about the same time as the oil-producing countries, and nationalized oil companies began to exert over the private oil companies, the “Seven Sisters.” OPEC has become one of the few resource production cartels that has coordinated prices and maintained coherence over time[1].

OPEC is critical to the world due to its ability to control prices and availability of petroleum – hereafter simply referred to as “oil” from the American perspective. The post will try to summarize how OPEN has managed to control oil and, more recently, influence the geopolitical landscape.

Roots of OPEC

Before the early 1970s, most of the world’s oil use capabilities went through the “seven sisters,” a cartel of seven major oil companies[2]. OPEC was founded as a group of oil-producing countries trying to counter the seven sisters' private company monopoly on end product prices. The seven sisters oil-purchasing cartel set prices and forced oil-producing nations to deal with them only as refiners.

The “last straw” of this system occurred in 1959. American oil companies cut the posted price of oil without consulting Saudi Arabia. To counter this move, the oil-producing nations set up OPEC in 1960. This began a series of new relations with oil companies. OPEC demanded that more money be directed to local subsidiaries, like Aramco, in Saudi Arabia.

The oil production, distribution, and processing infrastructure system started by companies were created and then favored the purchasers of raw crude. As OPEC gained more leverage over time, these agreements tended to change, giving more weight to the producing nations as multinationals built infrastructure in resource-rich countries[3]. OPEC underwent this phase of shifting power relationships in the early 1970s. By 1973, OPEC was ready to test its leverage.

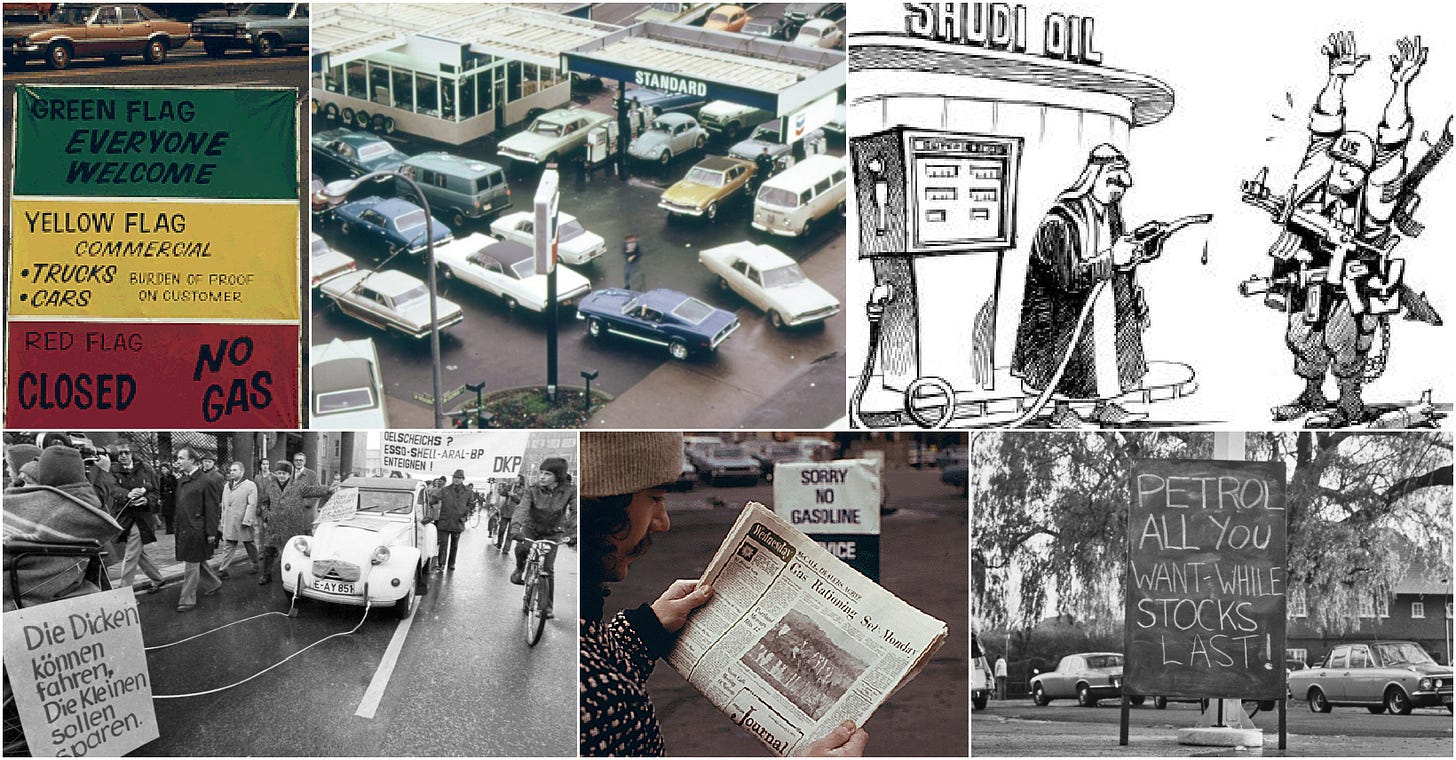

The Oil Embargo, 1973 – 1974

The Oil Embargo of 1973 was the first time OPEC fully flexed its power. It caused havoc to the world’s oil supply chain and consumers. The proximate cause of the oil embargo was to boycott certain consuming countries and punish countries’ support for Israel during the 1973 Yom Kippur War. The Arab members of OPEC declared an embargo against those nations that supported Israel in this war. The countries faced with the embargo were Canada, Japan, the Netherlands, Portugal, Rhodesia, South Africa, the United Kingdom, and the United States.

This hit particularly hard in October of 1973 as the United States was a net oil importer. By 1973, just before the embargo, the US imported 83% of the foreign oil from the Middle East. The prices held steady at $1.80 to $2.00 a barrel, which did not cover inflation. This made oil cheaper and cheaper over time. This situation was one of the critical enablers of American prosperity after WWII.

In the early 1970s, OPEC added new nations to control even more oil production. Meanwhile, the Soviet Union provided a new outlet for oil transportation and sales, reducing the control of the seven sisters. This allowed for greater flexibility in challenging the United States.

The Implementation of the Embargo.

October was the breakthrough in the war, and international relations were surrounded by it. On October 6th, Egypt and Syria attacked Israel. President Nixon was busy dealing with Watergate, and Henry Kissinger wanted to stall arms shipments to Israel, forcing a land-for-peace deal.

One of the severe issues in the war, unheralded at the time, was that the Soviet Union had prepped and loaded nuclear weapons in the Mediterranean in support of Syria and Egypt. This was one of the items that prompted the United States to increase efforts to support Israel. The actions of the Soviets moved the United States to issue a DEFCON 3 alert, and serious talks between the superpowers began.

October 12th changed the face of the war. Egypt and Syria had lost a lot of equipment in the war, which they could not replace. On October 12th, the Soviet Union started supplying those weapons. In the United States, President Nixon acquiesced to the opinion that the conflict in the Middle East was no longer a regional war but a Cold War conflict with the entrance of the Soviet Union. Nixon pledged to support Israel and began to increase arms shipments.

The Arab OPEC nations had discussed using oil as a weapon early in the war but delayed because they feared the response from the United States and the West. However, on October 13th, they decided to implement this action despite objections from Venezuela and Iran.

OPEC immediately raised the price from $3.01 to $11.65 by cutting production. This is important because oil is fungible. That is, a barrel of oil from OPEC can be replaced by a barrel from Norway. Therefore, blockading those countries might not affect them if they could get the same oil from elsewhere. To counter this, OPEC countries required assurances from oil company refiners not to sell to the United States and other boycotted countries. The spike in oil prices and gas lines fueled public fury in the United States. It was not recognized that the main reason for the gas lines was the inability of markets to respond because the energy market in the United States was an administered market. An inflexible government allocation system for gasoline distribution resulted in shortages in some areas and oversupply in others. This was compounded by government regulation of oil and natural gas prices. The market had little flexibility to adjust.[4]

After months of negotiations, the boycott ended in March 1974. OPEC agreed to end it as a negotiated end to the war was underway. The embargo was lifted, but the boycott had long-lasting effects.

Effects of the Boycott

The oil embargo affected different regions and countries in various ways. Here are some significant changes that occurred during and after the embargo.

Effect of the Boycott on the War

Interestingly, many scholars now believe that the embargo did not materially change the 1973 War. The same outcome of winners and losers would have occurred with or without the boycott. However, that conclusion avoids the significant effects that the boycott had on the world.

OPEC

The members of OPEC were rewarded and emboldened by the results of the embargo. The aims were rewarded, but even more critical were the lessons learned. OPEC learned that the major powers did not have enough leverage to make the producers stand down. This meant the Arab nations (and the other nations of OPEC) had a way to impose their interests onto the global stage. This power might be limited to cutting the oil supply to raise prices, but it was effective. Some nations, particularly Saudi Arabia and Kuwait, could easily cut production and avoid any direct adverse effects because they had plentiful funds and oil reserves.

On the other hand, OPEC and Arabs were vilified by the populations of embargoed countries. In the United States, this opinion has not changed but only deepened.

Europe

European nations decided to cut their use of oil by imposing extremely high taxes on oil. It did reduce nations’ per capita use of gasoline (petrol) significantly as drivers cut bank on use. Furthermore, European transportation alternatives, particularly enhanced train services, receive more public spending and greater use.

Proving the truth that taxes are often increased but rarely cut, those high gas taxes persist.

The United States

The United States responded differently to the situation than Europe. Instead of instituting new taxes, other methods were used.

During the crisis, the US government instituted fuel rationing.

Beginning in 1974, the public speed limit was reduced to 55 MPH nationwide. Enforcement was tied to getting highway funding from the feds, which was critical because the US did NOT raise gas taxes to pay for new roads and infrastructure improvements. This cap was not increased until 1995.

The nation embarked on a mission to increase its oil production and become independent in oil production—not just to reduce prices but to actively make the nation self-sufficient in energy in case of a war anywhere that threatened oil production or distribution in the future. This independence was achieved when new techniques, including fracking, were introduced.

The United States also implemented stockpiling of oil as the US oil reserve storage. It is called the Strategic Petroleum Reserve (SPR). The SPR is a complex of underground salt caverns that store emergency crude oil at four sites that can be called on as necessary.

In 1978, fuel economy standards were set for cars and then light trucks (light trucks meaning consumer trucks, not semis). These standards have had an unexpected side effect. Light trucks have some exceptions to MPG standards and lower standards overall. In the United States, producers and consumers have promoted the move to SUVs since SUVs can circumvent fuel economy standards as light truck definitions.

Non-OPEC oil producers’ benefits

Because oil production is not cost-based on the nation of production, non-OPEC nations benefit from coordination with OPEC. For example, the United States has convinced Saudi Arabia to increase production when the world supply is threatened. In return, the US supports and protects Saudi Arabia. But Saudi cooperation is not limited to the US.

Even before the Ukrainian invasion occurred, Russia coordinated with OPEC on the price and supply of oil. Rather than increasing oil production to keep prices low, as the US desired, Saudi Arabia worked with Russia to cut production and increase the price of oil, increasing the price per barrel for producers and allowing Russia to fund its war efforts more easily.

Effect on other Producer Cartels

OPEC seemed to point the way in the creation of other resource-based cartels. Cartels have been set up for Tin, Bauxite, Copper, and Coffee, but these attempts have been less successful than OPEC. OPEC benefits from the ability of one super producer to enforce OPEC rules. If a country drops prices to get a more significant share of the sales, Saudi Arabia can draw on its reserves to drive down the oil price overall. This will punish the offending producer.

If the flow of oil is reduced due to an OPEC member trying to institute an individual boycott of a country or if the output is affected by war, Saudi Arabia can increase its production to keep the price of oil stable.

Most of the other cartels do not have a single large producer that is nearly immune to price fluctuations due to its extensive monetary reserves.

Future

OPEC will continue to affect oil prices for the foreseeable future. Oil prices can be manipulated to deter the expansion of other energy sources. Why build expensive nuclear, solar, or wind farm solutions when oil prices are so low? OPEC can raise or drop prices, and those changes impact our desire and need to explore other energy sources.

Petroleum and petroleum products will be needed for a very long time. OPEC will continue to be critical for nations that consume energy until new energy sources are widely available. Therefore, OPEC and other producers will continue to drive availability in the future.

The only caveat is that if countries continue developing renewable energy sources, OPEC's power will be reduced.However, both oil producers and suppliers can drop prices, even temporarily, to fend off alternatives. In the United States, the biggest producer and user of petroleum products, the companies that profit from petroleum have lobbied against renewable energy sources. In the main, they have been very successful.

Human nature will continue to support cheap oil over more expensive forms of energy. For developing nations, oil can be delivered to current infrastructure, wiping out the ease of wide-scale transitions.

[1] The other major cartel that stayed consistent in membership and price were the cast members of Friends (FYI, just to see who is paying attention).

[2] The seven sisters were the Standard Oil Company of New Jersey (later Exxon), the Standard Oil Company of New York (Socony, later Mobil, which eventually merged with Exxon), the Standard Oil Company of California (Socal, later renamed Chevron), the Texas Oil Company (later renamed Texaco), Gulf Oil (which later merged with Chevron), Anglo-Persian (later British Petroleum), and Royal Dutch/Shell.

[3] Saudi Arabian Oil: The Obsolescing Bargaining Model (link)